When you get a notice from the IRS indicating an audit, it can be a daunting experience. The complex tax laws and formalities involved can make individuals feeling overwhelmed and confused. That's why obtaining experienced representation from a qualified accountancy professional in Florida is crucial for safeguarding your rights and finances.

- Expert IRS audit defense attorney holds in-depth expertise of the tax system and successful strategies for navigating audits.

- They can thoroughly review your financial records, detect any potential discrepancies, and construct a strong defense to mitigate the consequences of the audit.

- Furthermore, an experienced attorney can act as you during all stages of the examination process, ensuring your interests are protected.

Refrain from facing an IRS audit alone. Consult with a reputable tax attorney in Florida today to review your options and acquire the legal assistance you need to effectively manage your case.

Navigating IRS Audits with a Skilled Florida Tax Litigation Lawyer

Encountering an IRS audit can be a stressful and complex experience. The intricate laws governing federal taxation require a deep understanding of the system to effectively safeguard your interests. This is where having a skilled Florida tax litigation attorney becomes essential.

These legal experts possess extensive knowledge of IRS procedures and may guide you through every step of the audit process. They will meticulously review your financial records, identify any potential issues, and craft a strategic plan to minimize your tax liability and achieve the most favorable outcome.

, Moreover , a Florida tax litigation lawyer can:

* Stand for you before the IRS during audits and hearings, ensuring your rights are protected.

* Negotiate with IRS agents on your behalf to potentially resolve disputes amicably.

* Tax Litigation Lawyer in Florida Offer valuable guidance on tax planning strategies to help minimize future audit risks.

Choosing a skilled Florida tax litigation lawyer can be the difference between facing an audit alone and navigating it with confidence and skill.

Addressing Fort Lauderdale Tax Disputes | Protecting Your Rights as a Taxpayer

Facing a investigation? In Fort Lauderdale, a skilled tax attorney can be your greatest asset. Experienced in federal tax law, they represent you through the complexities of tax controversies, ensuring your rights are protected. From settlement to defense in court, a Fort Lauderdale tax attorney can help you achieve the most favorable outcome. Don't delay to seek legal assistance if you are facing tax issues.

A qualified tax attorney can analyze your case, identify potential concerns, and develop a customized solution to mitigate your liability. They will interact with the IRS or relevant tax authorities on your behalf, striving for a favorable resolution.

Overcoming Expert Tax Debt Resolution Strategies in Fort Lauderdale, FL {

Are you facing a daunting tax debt situation in Fort Lauderdale? Don't panic! One's not alone. Many individuals and businesses in our vibrant community experience similar financial hurdles. The good news is, there are proven expert tax debt resolution solutions available to help you achieve control of your finances. Seek with a qualified tax professional who specializes in Fort Lauderdale's unique tax regulations. They can analyze your specific situation, determine the best course of action, and guide you through the complex process.

A meticulous tax debt resolution plan may encompass several options, such as compromise with the IRS, payment plans, or even considering an offer in compromise. Keep in mind, a skilled tax attorney can advocate on your behalf and help you secure the best possible outcome.

Avoid postponing action. The longer you wait, the more complex your tax situation may become. Consider the first step towards financial freedom by reaching with a trusted tax expert in Fort Lauderdale today.

Ease Tax Stress with a Dedicated Fort Lauderdale Tax Attorney

Taxes tend to be a significant source of stress for individuals and businesses alike. Navigating complex tax laws and regulations can feel overwhelming, leading to anxiety and uncertainty. In Fort Lauderdale, there are experienced tax attorneys who specialize in providing personalized legal guidance to help you. By partnering with a dedicated tax attorney, you {canreduce your tax liabilities and avoid costly penalties.

- A qualified tax attorney has the ability to review your financial situation meticulously to identify potential tax savings opportunities.

- Their expertise includes represent you before the IRS in case of an audit or other tax disputes.

- Additionally, they are able to provide valuable advice on estate planning

Investing in a dedicated Fort Lauderdale tax attorney is a wise decision that may assist you through achieving your financial goals while avoiding unnecessary tax burdens.

Navigating the IRS: Secure Your Future with Expert Tax Defense in Florida

Are you dealing with an IRS audit or investigation? Don't panic. At our firm/our legal team/our practice, we have a comprehensive grasp of tax law and extensive experience in defending clients against IRS claims. Our experienced attorneys will work tirelessly to protect your rights and minimize your financial liability.

We understand that financial disputes can be daunting and stressful. That's why we offer tailored solutions to meet your unique needs. Whether you are facing an audit, a collection action, or criminal tax charges, our team will provide expert direction every step of the way.

{Don't let the IRSburden you. Contact us today for a free consultation. Our experienced tax defense attorneys/legal professionals/experts are ready to help you resolve your tax issues.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Christina Ricci Then & Now!

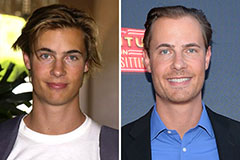

Christina Ricci Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!